Dive Brief:

- 3M’s third quarter net sales increased approximately 3.5% year over year to $6.5 billion, once again topping its expectations, according to the chemical and consumer goods manufacturer’s earnings report on Tuesday.

- By geography, China continues to lead the company’s growth with strength in industrial adhesives films and electronics bonding products, driven by 3M’s strategic commercial growth plan, EVP and CFO Anurag Maheshwari said during the Oct. 21 earnings call.

- 3M modified its outlook following its Q3 results, raising its earnings per share guidance from $7.75 and $8 to a range between $7.95 and $8.05, Maheshwari said.

Dive Insight:

3M’s business in China has been resilient as it revamps its organizational model in the country, as well as in India, Brown said on the earnings call. The company’s product distribution for domestic and export is split evenly, Brown said, with China exports in September up approximately 8%.

Approximately 56% of the company’s Q3 revenue came from outside the U.S., according to the Q3 securities filing, making 3M’s global operations vulnerable amid the ongoing tensions between the U.S. and China, particularly.

3M is pursuing original equipment manufacturers in China, which is driving growth in its transportation and electronics business. The company is able to launch new products and pursue China OEMs to keep pace with the country’s new vehicle launches, Chairman and CEO Bill Brown said on the earnings call.

“To capture those opportunities, you have to innovate,” Brown said. “You have to innovate at a pace that’s consistent with the pace at which these OEMs are launching vehicles in a year or in 18 months or even less than that.”

3M initially announced its new strategy, dubbed “3M Excellence,” at its Investor Day in February, focusing on accelerating growth in innovation, commercial and operations.

The strategy included the manufacturing company investing $3.5 billion in research and development, with the goal of launching 1,000 products over the next three years.

The strategy is working and yielding results, Brown said. 3M launched 70 products in Q3 and has already introduced a total of 196 in 2025, with both increases of approximately 70% compared to last year.

The company now expects to launch over 250 new products by year’s end, exceeding its initial goal of 215, as it accelerates its pace to reach 1,000 new products by 2027, Brown added.

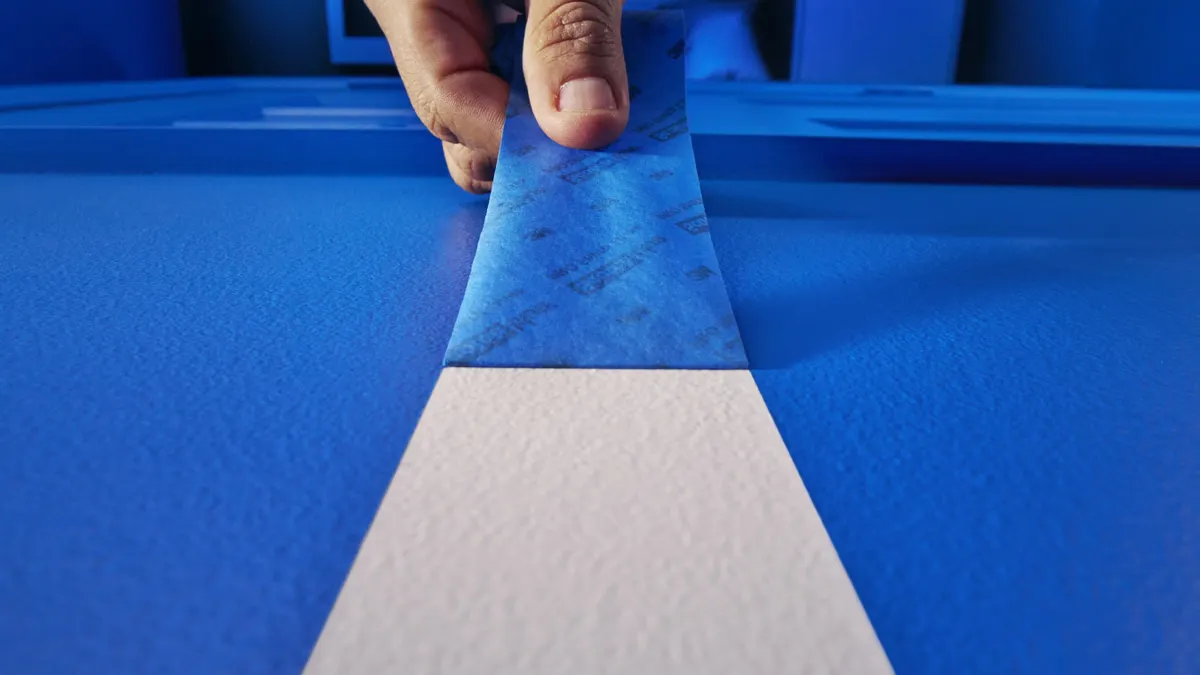

The CEO highlighted a couple of new products introduced this year that contributed to its Q3 performance, including the ScotchBlue ProSharp Painter’s Tape, which launched in May. The new painter’s tape in 3M’s consumer business replaced an “existing offering in this space, but with a better performance and cost profile,” Brown said. “We’re now regaining share, growing high single digits and outperforming in the category.”

Brown noted that the new product innovation contributed to 3M’s third-quarter revenue, but attributed much of the growth to the company’s commercial “effectiveness” and “efficiency.” He added that NPI’s revenue contribution will build over time.

“The reality is, as we launch more products, it’s very clear that it’s changing the discussion with our customers,” Brown said. “Even if it’s a typical replacement or there’s some cannibalization, it’s allowing a different conversation with the customer. We’re gaining shelf space, and that’s really encouraging to our customers, and we’re winning business simply because we’re launching more products.”

3M has also been evaluating its portfolio through a profit lens in an effort to shift its businesses toward higher growth since February, Brown said, adding that 2% to 3% of its revenue has been under review for divestiture.

In June, 3M completed the sale of its silica business that was formerly part of the transportation and electronics business for “immaterial proceeds slightly below the business’s book value,” according to the manufacturer’s Q3 securities filing. The sale number and the buyer were not disclosed.

Additionally, the company made progress with a deal to sell its precision grinding and finishing business within its safety and industrial business group in Q3, Brown said. 3M documented a pre-tax charge of $161 million due to its market value being lower than its selling price, according to the securities filing. The segment has annual sales of approximately $130 million, which accounts for less than 1% of 3M’s sales, but it’s “been a drag on results with over a decade of sales decline” in seven underutilized factories across the U.S., Europe and China, Brown added. The deal is slated to close in the first half of 2026.

“This is a good outcome for shareholders, and it’s indicative of the portfolio shaping we spoke about at Investor Day that enables us to be a more focused and higher performing enterprise,” the CEO said.

Additionally, the company spent $14 million in Q3 toward “long-term transformation efforts” to redesign 3M’s manufacturing, distribution and business process services and locations, Maheshwari said on the call.

Despite the company’s sales on the rise, 3M is facing more lawsuits accusing the consumer and chemical manufacturer of PFAS contamination. Brown said the lawsuits against the company are under 14,000, with each case having multiple claims that 3M is currently vetting.

3M, along with other chemical titans such as DuPont de Nemours and Chemours Co., were slated to have a court date on Oct. 20 for the first bellwether personal injury trial, according to the filing. The plaintiffs are accusing the companies of causing kidney cancer due to their PFAS usage. The court has directed all parties to negotiate and reach a settlement ahead of the trial.

The case has been delayed to allow new cases to be filed in an effort to manage the caseload in the docket, Brown added.

Additionally, the trial has been delayed due to a lack of funds resulting from the government shutdown, according to a court filing dated Oct. 1.