Throughout 2025, the White House has taken steps to ramp up the domestic defense industrial base to strengthen the U.S. military and its fighting capabilities, as well as defend the nation amid growing global tensions.

Shortly after returning to office, President Donald Trump signed an executive order to overhaul the Department of Defense’s acquisition process and accelerate innovation under the agency’s industrial base.

In December, Trump signed the National Defense Authorization Act for fiscal year 2026, valued at $901 billion. The NDAA budget includes provisions to strengthen domestic manufacturing and advance technologies across the U.S. defense industrial base.

Additionally, DOD released plans to address Trump’s requests. In November 2025, the agency released its Acquisition Transformation Strategy that aims to increase and accelerate production capacity for key systems, weapons and munitions for the U.S. military and prioritize the country’s allies and partners.

Furthermore, the Defense Department released its 2026 National Defense Strategy in January. The plan includes reshoring specific industries by investing in U.S. defense production, building out capacity and enabling innovation. Moreover, the agency plans to adopt modern technologies such as artificial intelligence.

Some defense companies have recently reached deals with the Defense Department. Read more below to see who heeded the agency’s call.

Lockheed Martin, DOD ink deals to expand missile interceptor production

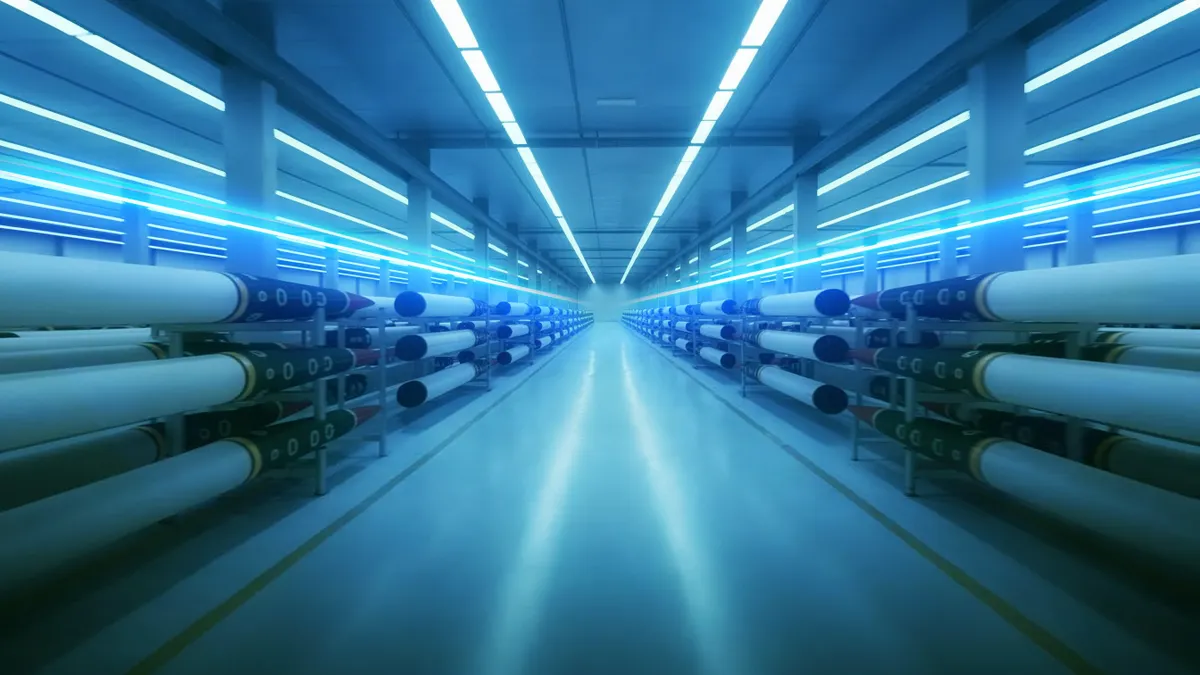

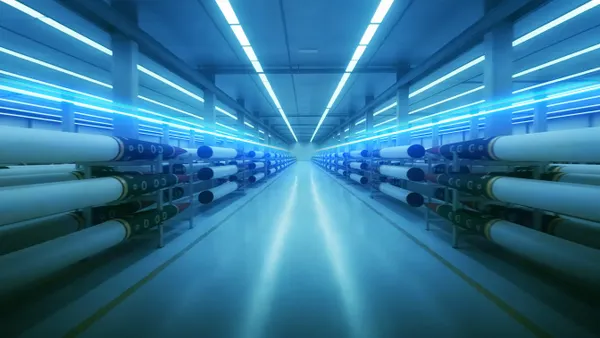

Weapons system maker Lockheed Martin and the Defense Department announced on Jan. 29 that they signed an agreement to quadruple production of the company’s terminal high altitude area defense interceptors.

The THAAD interceptors are a weapon system that impacts and destroys missiles before they reach their intended targets. Under the DOD deal, Lockheed will be able to produce the THAAD interceptors at an annual rate of 96 to 400 over the next seven years, according to the press release.

The company also broke ground on a new Munitions Acceleration Center in Camden, Arkansas, in support of its ramp-up production plans. The facility will train new workers to build the THAAD and PAC-3 interceptors, as well as other capabilities utilizing advanced manufacturing, robotics and digital technologies.

The agreement builds on Lockheed and DOD’s PAC-3 agreement announced Jan. 6. The deal aims to accelerate production and delivery of Lockheed’s PAC-3 missile segment enhancement interceptors. It will increase Lockheed’s annual production rate of the PAC-3 MSE interceptors from 600 to 2,000 over the next seven years, according to DOD’s press release.

“These types of agreements fully support the [Department of Defense’s] Acquisition Transformation Strategy, and we look forward to continuing our partnership with the U.S. government to definitize the contract and unleash a renewed era of innovation, accountability and execution across the defense industrial base,” James Taiclet, chairman, president and CEO, said on a Jan. 29 earnings call.

Lockheed plans to invest billions of dollars over the next three years to expand production and build and upgrade more than 20 facilities in Arkansas, Alabama, Florida, Massachusetts and Texas, according to the Jan. 29 press release. The investment will also cover incorporating advanced manufacturing techniques, production lines, tooling and plant layouts to meet the production demand.

L3Harris Technologies to establish $1B mission solutions business

L3Harris Technologies entered an agreement with the Defense Department to launch a missile solutions business to increase capacity to build solid rocket motors, according to a Jan. 13 press release.

The agency pledged $1 billion, which would be converted into stock once the new company goes public.

L3Harris aims to pursue the new business’ initial public offering in the second half of 2026, which will also focus on delivering propulsion systems and an “unprecedented speed and scale.”

The deal supports the “Arsenal of Freedom,” a blueprint to rebuild the defense industrial base under DOD’s New Acquisition Transformation strategy, according to the press release. Furthermore, the agreement will aid in accelerating L3Harris’ missile solutions capacity expansion for the agency’s missiles programs, such as PAC-3 and THAAD.

In July 2023, L3Harris acquired rocketmaker Aerojet Rocketdyne and its facilities for $4.7 billion. L3Harris has since transformed Aerojet, positioning the missile solutions business for growth, CFO and Senior VP Kenneth Bedingfield said on a Jan. 13 call with analysts.

“The [Department of Defense’s] investment reflects a shared objective to expand industrial base capacity and reduce supply chain risk,” Bedingfield said. “Through its $1 billion preferred convertible investment, the Department of [Defense] participates economically in the long-term success of the business with any conversion subject to future IPO and market conditions.