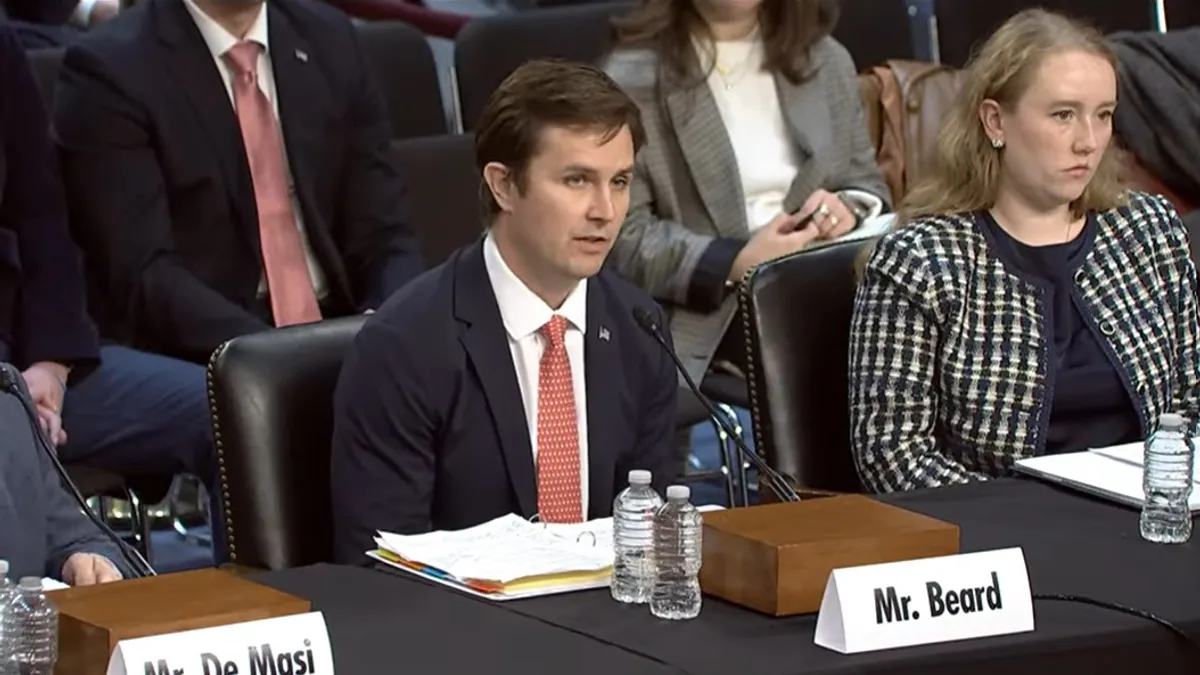

In the race to build automated robots for industrial purposes, high costs are keeping U.S.-based manufacturers from being competitive in the market, an executive said at a congressional joint economic hearing on technology and innovation last week.

In terms of sourcing for parts, “today U.S. quotes are ten times higher than Chinese suppliers,” said Standard Bots CEO Evan Beard, placing his company and others at a competitive disadvantage as demand for automation swells.

The New York-based startup’s robotic arms are used in factories owned and operated by Lockheed Martin, Verizon, NASA and other customers to automate certain tasks. They are also unique in that they are manufactured by a U.S.-based company, Beard said. Some of the biggest players may build their robots in the states, such as ABB or Fanuc, but have headquarters in Asia or Europe.

“Our competitors already have national strategies,” Beard told lawmakers. He argued that “America does not have a specific, actionable and funded plan to lead in advanced manufacturing and robotics.”

Beard recommended a four-part plan to change that, including increased federal funding for loans and manufacturing excellence centers to support U.S. manufacturers and address market inequalities with foreign competitors.

“If other countries are subsidizing their robots, like China, how do we expect American companies to compete to ensure a level, fair playing field for the domestic robotics industry?” he said.

The Trump administration has made strengthening U.S. manufacturing a cornerstone of its agenda, enacting tax incentives over the summer that encourage facility expansions and launching a new revolving credit program for small manufacturers last month.

The administration also moved to defund the Commerce Department’s Manufacturing Extension Partnership program earlier this year, but walked its decision back following pushback from lawmakers and advocates.

Small manufacturers have leveraged MEP centers for support, expertise and strategies that strengthen their competitiveness for decades. According to its website, the program has helped thousands of companies, generating $60 billion in new sales and creating or retaining more than 1.4 million jobs since 2000. However, Commerce Secretary Lutnick said in a June budget hearing that he wants to “reexamine and retool” outdated programs like MEP to be better suited for AI.

“We believe Congress should fully fund this network,” Beard said last week. He proposed a “redesigned” MEP program that gives manufacturers hands-on access to the latest production tools and technologies and offers comprehensive training to workers, entrepreneurs and employers.

The program can also assist with the nation’s skilled worker shortage by acting as the connective tissue between employers and nearby schools, creating a robotics curriculum for students with real-world applications so they can earn high-wage jobs.

Additionally, Beard urged lawmakers to create a lending program modeled after Energy Department programs that provide low-cost, long-term loans and loan guarantees to help manufacturers with capital and operating costs, including equipment purchases, expansions and hiring.

He also recommended the Trump administration to implement a ban on industrial robots made in China, citing national security risks posed by robots with cameras, or to implement tariffs that counter foreign subsidies and create a “fair competitive landscape for American suppliers.”

While robots from China are not currently dominating U.S. imports compared to companies based in Japan and Europe, their inexpensive products will eventually come to market as automation demand swells, Beard warned in his testimony.

“America has the talent, the ingenuity and the drive to lead the world in making things, but every month we wait, our manufacturing base slips farther behind,” he said.