Nippon Steel on Wednesday finalized its nearly $14.2 billion takeover of U.S. Steel, bringing the years-long acquisition saga to a potential close.

The Japan-based steelmaker, which first proposed buying U.S. Steel in December 2023 for $55 per share, now owns the American company as a subsidiary. U.S. Steel will maintain its Pittsburgh headquarters.

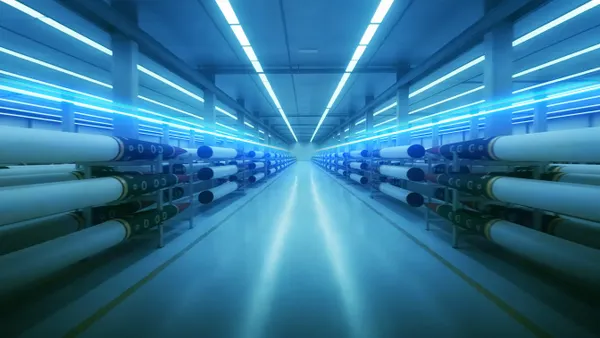

The deal promises to "protect and create" 100,000 jobs through steelmaking investments across Pennsylvania, Indiana, Arkansas, Minnesota and Alabama. As a result of the acquisition, Nippon expects its annual crude steel production capacity to hit 86 million tons, making it the fourth largest steel producer in the world.

The companies' joint announcement also offered more details surrounding what control the U.S. government will have over the new partnership through its "golden share," a key provision used to garner President Donald Trump's recent approval of the deal. The two companies signed a national security agreement with the U.S. government to secure approval.

The U.S. government will have the ability to appoint one independent director and give the president or a designee consent rights over specific matters, including:

- Reductions in committed capital investments under the national security agreement signed by the companies

- Changes to U.S. Steel's company name or headquarters

- Moving U.S. Steel outside the country

- Moving jobs outside the country

- Acquisitions of U.S. competitors

- Decisions regarding the closure of domestic manufacturing facilities, trade, labor and sourcing outside the U.S.

Nippon reiterated its commitment to invest $11 billion in the U.S. by 2028, as well as plans to build a new facility after that time. The steelmaker also said U.S. Steel will maintain capacity to supply products from its domestic facilities to meet market demand.

The company stated that a majority of the new entity's board of directors would be U.S. citizens, as well as the CEO, CFO and other roles.

The future of Nippon’s acquisition of U.S. Steel has often been in doubt over the past 18 months. Former President Joe Biden rejected the deal before leaving office in January, and former Vice President Kamala Harris had also said during the presidential campaign that she would block the deal.

Nippon’s larger U.S. foothold may also help it evade Trump’s 50% steel tariffs that announced last month during a visit to U.S. Steel in Pittsburgh. The company specified in a presentation Wednesday that tariffs would spark shifts in direct and indirect imports to domestic production.

The finalization of the deal comes days after Trump signed off on the deal by executive order. U.S. Steel on Wednesday requested it be suspended from trading amid the acquisition, according to a securities filing.