Feb. 3: Edgewell Personal Care has completed the $340 million sale of its North America feminine care business to Stockholm-based Essity, the company announced Feb. 2.

The proceeds from the sale will be used to improve its financial position, pay down its revolving loan facility, and support Edgewell's growth.

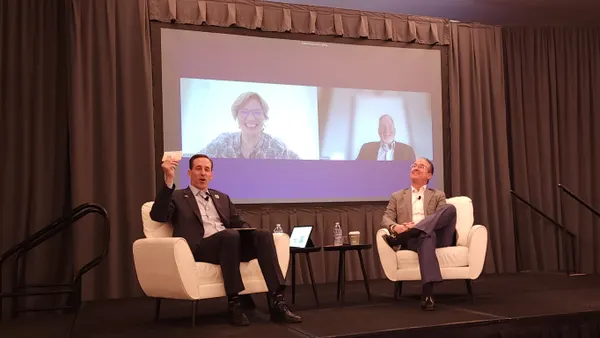

Looking ahead, the divestiture impact will not be reflected in Edgewell’s fiscal 2026 outlook and instead will be reported as discontinued operations beginning in the first quarter, CFO Francesca Weissman said in a November 2025 earnings call.

Dive Brief:

- Nov. 17, 2025: Edgewell Personal Care plans to consolidate its manufacturing operations as part of a restructuring aimed at cutting costs.

- The company will combine four manufacturing factory sites in North America into a “single-scaled automated plant” in an undisclosed location, President and CEO Rod Little said on Edgewell’s Nov. 13 earnings call.

- The company’s plan includes selling its North America feminine care business for $340 million to Stockholm-based hygiene and health company Essity, with a production facility in Dover, Delaware, as part of the deal.

Dive Insight:

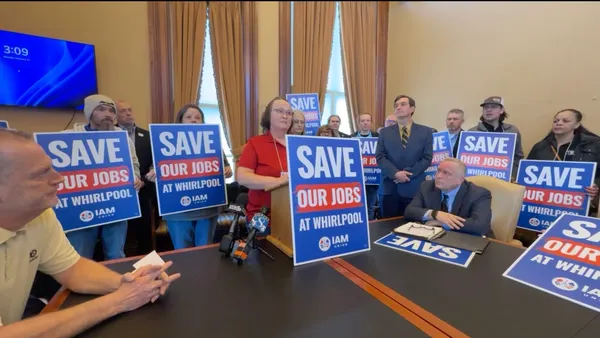

The consolidation means the product care maker will shutter four manufacturing sites in North America, including the Schick brand facility in Milford, Connecticut, an Edgewell spokesperson said in an email.

The Milford location is scheduled to close by the end of December 2027, cutting 293 jobs, according to a Worker Adjustment and Retraining Notification letter sent Nov. 13 to the state. The first round of layoffs will commence in March 2026.

The company did not share the location of its other North American manufacturing facilities due to “competitive reasons,” the Edgewell spokesperson said.

As for its feminine care business, which makes brands such as Playtex, Stayfree and o.b., Edgewell plans to use the sale funds to strengthen its balance sheet and invest in the long-term growth of its core businesses. Those categories are shave, sun and skin care, and grooming.

“This transaction marks a pivotal step in Edgewell’s transformation,” Little said in a statement, adding that the divestiture will also enable the product care maker to hone its focus on its core categories.

For Essity, the feminine care segment acquisition would enable the Sweden-based company to build a stronger personal care business in North America as part of its strategy focusing on “attractive geographies” that yield high financial returns, Ulrika Kolsrud, Essity president and CEO, said in a statement.

With the feminine care sale pending, Edgewell intends to place its attention and resources on categories where the company has “clear competitive advantages and strong momentum,” Little said on the recent earnings call.

The company has been implementing changes in its business model as “fiscal 2025 was a challenging year,” CFO Francesca Weissman said on the call. The challenges were rooted in external factors such as tariffs, currency fluctuations, geopolitical uncertainty as well as a “softer-than-expected sun care season and slower recovery in feminine care.”

Edgewell ended the fourth quarter with a 3.8% increase in net sales at $537.2 million, according to its earnings report. Full-year sales, however, decreased 1.3% to $2.2 billion compared to last year.

Looking ahead, Edgewell executives expect fiscal year 2026 to be “a year of transition and solidifying foundations for long-term growth” as it works to stabilize its North America business, Little said. The company is also expecting macro-environmental challenges to remain, with slow category growth and consumers cautious about spending.