Dive Brief:

- Chip design software maker Cadence Design Systems has agreed to acquire the design and engineering business of Hexagon, a Stockholm-based industrial technology firm, for roughly $3.18 billion in cash and stock.

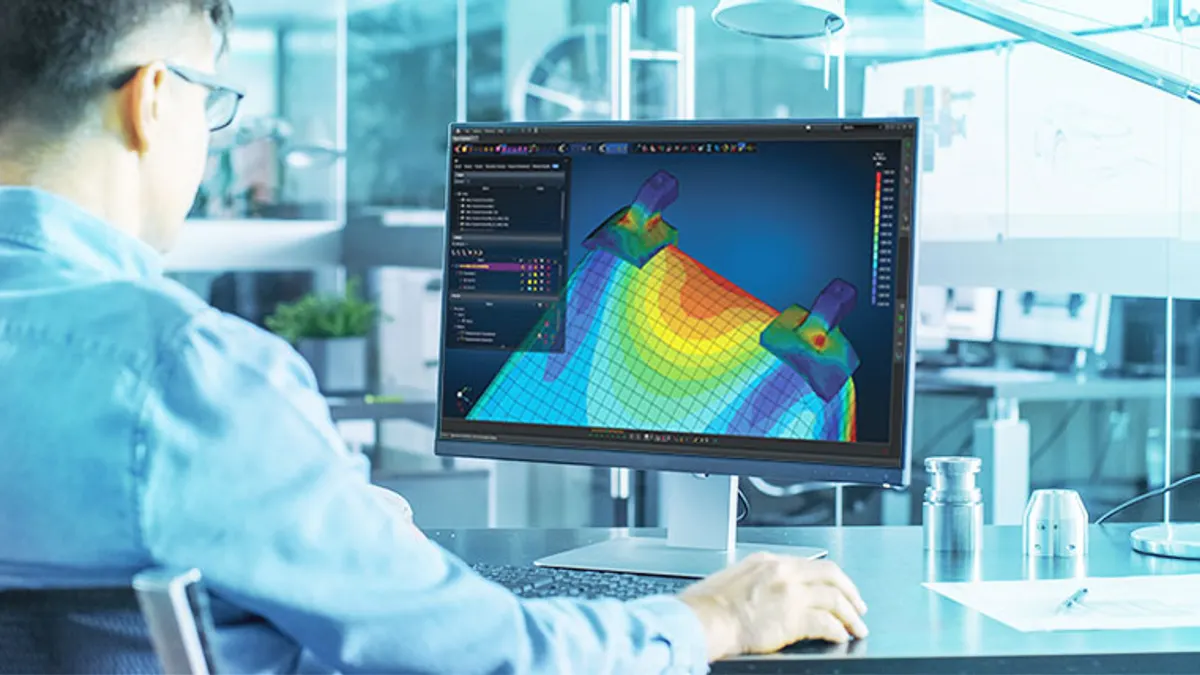

- The deal, if approved by regulators, would expand Cadence’s portfolio to include multiphysics simulation software used widely across the aerospace and automotive sectors. It is expected to close in the first quarter of 2026.

- The acquisition would expand the San Jose, California-based firm’s intelligent system design strategy and build on its previous acquisition of Beta CAE, bolstering its position in the multi-billion-dollar structural analysis market.

Dive Insight:

Simulation tools are becoming more important to manufacturers as industries transition to more complex electric vehicles, autonomous systems and advanced materials.

Hyperconvergence, a term used to describe the combination of storage, computing and networking into a single system, is making it so engineers need simulations earlier in the design process, Cadence said. Rapid technological evolution is fueling stronger demand for structural analysis tools.

Cadence said it has built out its system analysis portfolio to include electromagnetics, electrothermal and computational fluid dynamics. With the addition of Hexagon’s D&E business, Cadence said it can deliver a more comprehensive multiphysics platform for customers.

Hexagon’s D&E business is responsible for industry tools such as MSC Nastran and Adams, which are widely used by Boeing, Lockheed Martin, BMW, Toyota and more for structural and multibody dynamics simulation. Its more than 1,100 employees would transition to Cadence as part of the agreement.

Cadence said Hexagon’s D&E tools are important for the design and validation of complex mechanical systems and are positioned to play a critical role in the emerging fields of robotics and physical artificial intelligence.

With the addition of Hexagon’s simulation technologies, Cadence can expand its capabilities to cover a fuller range of physical behavior, including electromagnetics, fluids, structures and motion.

“This will be a pivotal step in enabling our customers to design the complex, converged systems of tomorrow,” Anirudh Devgan, Cadence’s president and CEO, said in a statement.

Hexagon agreed to sell its D&E business in an effort to simplify its portfolio of industrial technology products. Its D&E business was part of MSC Software, which Hexagon acquired in 2017. The company has since been working to transition the business to a subscription model. However, the engineering simulation market is evolving rapidly and “harder for Hexagon to follow,” Chairman Ola Rollén said in a statement.

“By transitioning D&E to Cadence, a global leader in this field, and establishing a long-term collaboration between our companies, we are creating a stronger future for our customers, employees, and shareholders,” Rollén said.

The D&E business generated 265 million euros, or roughly $280 million, in revenue last year. Hexagon said it plans to use the sale’s proceeds to fund future acquisitions or pay down debt loads. The company is awaiting regulatory approval to spin off its asset lifecycle intelligence and safety, infrastructure and geospatial divisions, into a company called Octave, next year.