Boeing’s recovery continues in 2025 as the company’s third-quarter revenue jumped 30% year-over-year to approximately $23.3 billion, driven by a stronger commercial and defense aircraft delivery volume, per an earnings report released Oct. 29.

Q3 net losses slightly improved, dropping nearly 14% to about $5.3 billion, compared to $6.2 billion last year. The net losses reflect a $4.9 billion charge as the company delayed delivery of its 777-9 aircraft from 2026 to 2027 after revising the program’s production plans to meet the Federal Aviation Administration’s requirements, CFO Jay Malave said on the earnings call last week.

Still, the company’s commercial segment has continued to grow in production, particularly for its 737 aircraft. Last month, the FAA agreed to increase 737 production from 38 to 42 planes per month, CEO and President Kelly Ortberg said on the earnings call.

The agency also allowed Boeing limited authorization to issue airworthiness certificates for some of its 737 Max and 787 Dreamliner plane models in September.

Additionally, Boeing is one step closer to owning one of its suppliers. The company gained the European Commission’s approval on Oct. 13 to acquire fuselage supplier Spirit AeroSystems for $4.7 billion, though with some prerequisites. Now, the company is waiting for U.S. approval, Ortberg said.

“While we’re turning the corner, we’re well aware of the work ahead of us to fully recover our performance, particularly on our commercial development and certification programs,” Ortberg said.

IAM strike impact

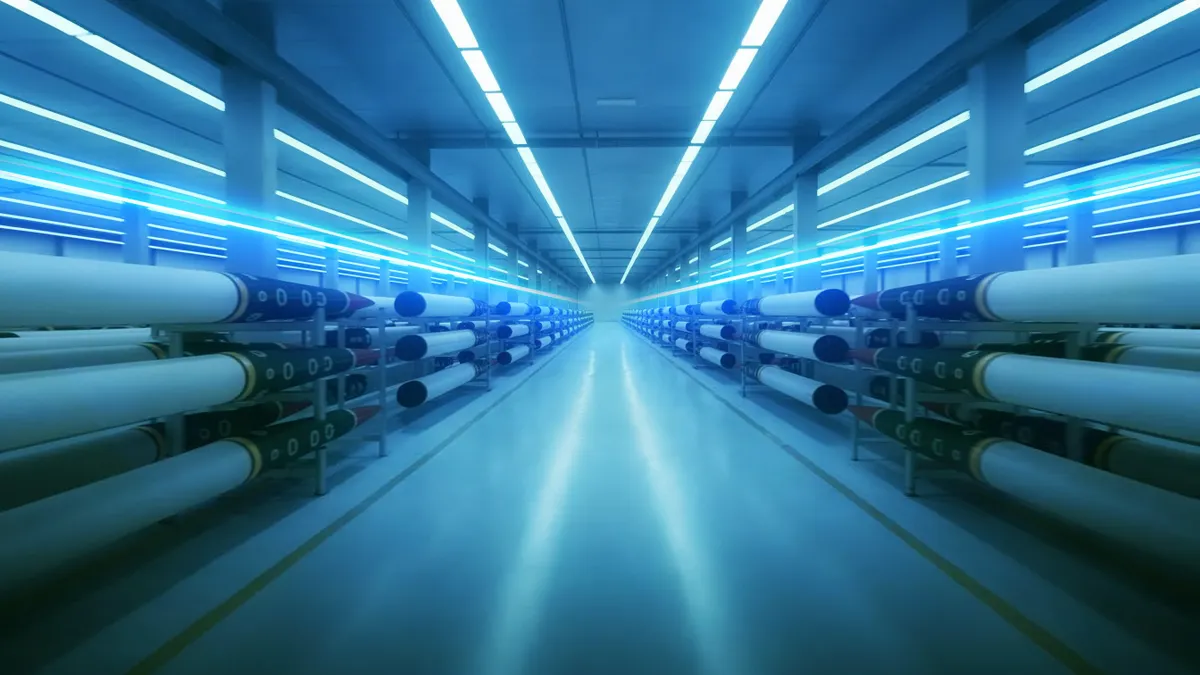

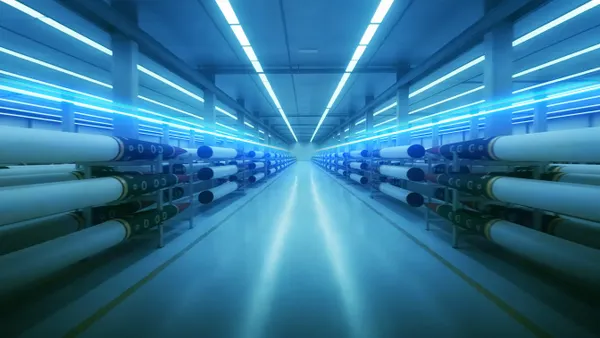

Approximately 3,200 Boeing workers represented by the International Association of Machinists and Aerospace Workers District 837 at the company’s St. Louis area fighter jet and weapons plants have been on strike since Aug. 4.

While Boeing’s commercial segment is helping the plane maker recover financially, the ongoing Machinists’ strike at its St. Louis-area facilities has not impacted Boeing’s defense, space and security segment revenue, increasing 25% YoY to $6.9 billion. Additionally, the defense segment backlog, which comprises of prominent customers including the U.S. Navy and Air Force and foreign militaries, grew to $76 billion, of which 20% was from customers outside the U.S.

In July, the defense segment secured a $2.8 billion contract from the U.S. Space Force for two space vehicles, with an option to deliver two more.

Despite the insubstantial financial impact, the worker stoppage has disrupted Boeing’s fighter jet and weapons factory operations, according to the plane maker’s Q3 securities filing. Last month, Air Force Chief of Staff-elect Gen. Kenneth Wilsbach told the Senate Armed Services Committee that the F-15EX deliveries were delayed as a result of the strike.

Currently, the Air Force is set to receive 129 F-15EX and anticipates obtaining 126 by 2030, which is nine months behind schedule, Breaking Defense reported. The Air Force reportedly plans to purchase additional fighter aircraft as part of its 10-year plan submitted to Congress last month in an effort to meet President Donald Trump’s interim national defense strategy.

“If we are unable to successfully negotiate a new contract with IAM 837 and the strike continues for a prolonged period, our financial position, results of operations and cash flows could be materially impacted,” according to the securities filing.

Negotiations stalled

Negotiations between IAM and Boeing remain tense as the strike enters its fourth month, as union-represented workers voted to reject the company’s proposed contract for the fourth time on Oct. 26.

Last week, IAM presented its modified proposal, which included a “significant concession” on 401(k) benefits, but the company rejected the offer. The rejection prompted IAM to file another unfair labor practice charge against Boeing.

The union added in an Oct. 31 press release that its latest proposal is approximately $8 million more over four years compared to the first four years of Boeing’s five-year offer.

Boeing is also receiving pressure from Congress to resolve the work stoppage. An Oct. 28 letter signed by 17 bipartisan U.S. representatives urged the company to return to the negotiating table for the sake of “national security interests and longstanding national policy.”

BDS’s results also included “immaterial impacts” associated with the strike, Malave said, adding that Boeing has been implementing its contingency plan to replace the fighter jet workers.

Brian Bryant, international president of the International Association of Machinists and Aerospace Workers, said in an Oct. 29 statement that the company’s contingency plan is failing because Boeing cannot replace union-represented workers with the same skill and experience.

“Investors must also take into account Boeing’s continued failure to manage labor relations responsibly,” Bryant said. “The company’s refusal to engage in fair bargaining is not only hurting workers and national defense programs — it’s a risk to Boeing’s long-term stability, reputation, and credibility.”

Boeing responded to IAM’s statement on Oct. 30, saying that its contingency plan has always involved using resources and skills from across its business as well as contractors and suppliers. The company also said non-union workers, union-represented workers who crossed the picket line and permanent replacement employees have been working on the fighter aircraft.

“We encourage union leaders to end the rhetoric and reconsider our market-leading contract offer that fell just a few votes shy of ratification, which on Day 1 would increase the average wage for IAM 837 members to just over $40 per hour,” Boeing said in an unattributed statement.