The United States semiconductor manufacturing industry continues to experience rapid growth and transformation, fueled by strategic government initiatives and increasing investments from major companies.

Key Takeaways:

- AI-driven demand is accelerating semiconductor plant construction across the United States, with major investments from public and private sectors fueling rapid industry growth.

- The West is emerging as a key hub for advanced manufacturing, thanks to business-friendly policies, favorable climate, and significant infrastructure investments in states like Idaho, Arizona, Texas and Colorado.

- Workforce shortages remain a critical challenge, prompting companies to invest in education and training partnerships to build a skilled talent pipeline for future semiconductor projects.

Central to the momentum of semiconductor manufacturing in the United States is the CHIPS and Science Act, passed by the Biden administration in 2022, which allocated approximately $53 billion to bolster domestic semiconductor production, research and workforce development. This legislation has prompted companies to expand operations and invest in United States-based manufacturing.

Three years on, funding continues to flow, while new policies from the current administration are accelerating the industry's growth, reinforcing America's commitment to technological leadership and a resilient supply chain.

We’re seeing significant investments and major project announcements from top manufacturers across the country. While government initiatives help build momentum, challenges remain around funding, legislation and workforce availability. Successfully navigating these complexities requires both expertise and adaptability, especially for general contractors who play a critical role in supporting manufacturing companies.

Here’s a look at three trends impacting the semiconductor manufacturing industry in the United States.

How the AI Boom is Driving Semiconductor Plant Construction in the U.S.

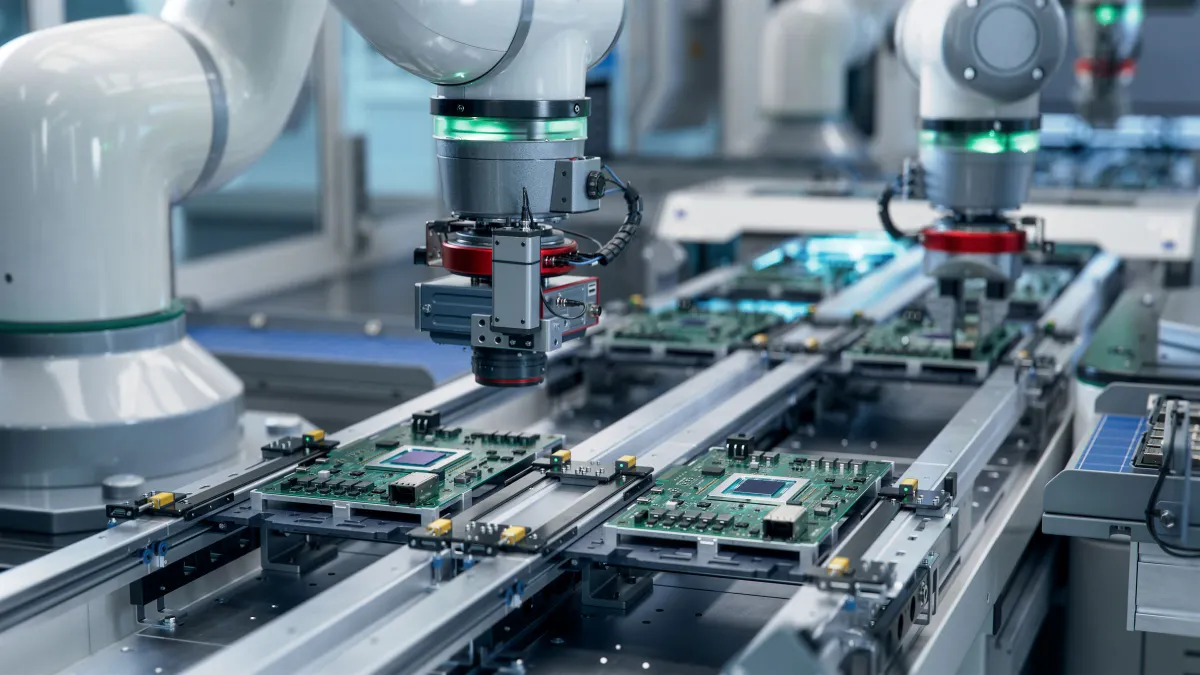

The semiconductor industry is racing to meet the growing computational demands of advanced artificial intelligence (AI) platforms like ChatGPT, Google’s Gemini and Microsoft’s Copilot. As large language models become mainstream tools for millions of users, manufacturers are scaling up their capabilities to support the next generation of high-performance computing, further driving semiconductor fabrication plant (fab) construction globally.

While ongoing uncertainty around tariffs and federal legislation has led some companies to reevaluate their timelines or phase their investments, many are doubling down on United States expansion. According to the Semiconductor Industry Association, private sector commitments to semiconductor manufacturing on American soil have exceeded $500 billion since 2020, which is on top of the federal funding from the CHIPS and Science Act.

In April 2025, Nvidia committed to spending $500 billion to manufacture its Blackwell chip and other artificial intelligence infrastructure in Arizona and Texas over the next four years. In September 2025, Nvidia continued to bolster investments with the purchase of a $5 billion stake in Intel, weeks after the United States government purchased a 10% stake in the technology company. This domestic momentum is also being driven by enhanced tax incentives under the Trump administration’s “One Big Beautiful Bill Act,” which raised the investment tax credit for United States-based fab construction from 25% to 35%, provided projects break ground before December 31, 2026.

Together, these funds are projected to triple chipmaking capacity in the United States by 2032 and generate over 500,000 new American jobs. Four new major fab construction projects have been announced that are expected to break ground before the end of 2025.

Why Western States are Becoming Semiconductor Manufacturing Leaders

Western states, including Idaho, Colorado, Arizona and Texas are emerging as appealing geographies for semiconductor manufacturing facilities. Business-friendly legislation and incentives, as well as the natural climate, have made these states appealing to manufacturers selecting sites for their next plants. In Idaho, Colorado and Arizona, abundant sunlight creates strong potential for solar energy, and these regions are generally spared from major natural disasters such as hurricanes and floods.

Arizona, in particular, stands out as a frontrunner for rapid growth in manufacturing construction. The state’s abundant land, existing infrastructure, streamlined regulations, and supply of skilled workers in engineering, technology, and manufacturing have attracted major semiconductor companies like Intel and Taiwan Semiconductor Manufacturing Company (TSMC). TSMC ramped up production of its “GIGAFAB cluster” north of Phoenix, which will include three chip facilities, two advanced packaging fabs for AI, and a research and development center. The company plans to produce a third of its most advanced chips in the state. This facility is part of a $165 billion investment in semiconductor manufacturing in the United States. After initially committing $65 billion to its Arizona fab operations, the company announced an additional $100 billion in funding for its American expansion in March 2025.

Texas is also making major strides in semiconductor development. In 2023, Governor Greg Abbott signed the Texas CHIPS Act, allocating $1.4 billion to support semiconductor manufacturing and research. This funding is being used to attract new projects and support academic institutions like the University of Texas at Austin and Texas A&M University in chip design and innovation. Samsung is building a $17 billion fabrication plant near Austin, scheduled to open in 2026, while Texas Instruments is investing $60 billion in a megaproject that includes four fabs in Sherman, one in Richardson, and two in Lehi, Utah. The Sherman facility is expected to begin full production by the end of 2025, reinforcing Texas’s position as a key player in the U.S. semiconductor landscape.

How the Semiconductor Industry is Addressing Workforce Shortages

Despite receiving billions in funding, the semiconductor industry continues to face a critical shortage of skilled labor. According to Deloitte, by 2030 the industry will require over one million additional skilled workers to meet growing demand. Engineers, technicians and fab operators are especially in high demand, but the current talent pipeline has struggled to keep pace. With the number of fab projects coming down the pipeline, this talent gap is likely to persist.

To address this, companies are increasingly investing in workforce development at the college level. Across Texas, Arizona and other states leading the semiconductor manufacturing industry, major firms are partnering with universities and community colleges to introduce hands-on training with industry-relevant coursework. These early education initiatives aim to build a stronger, more prepared workforce from the ground up.

Federal support has also played a key role. In 2024, the Biden administration allocated $1.6 billion from the CHIPS and Science Act to support semiconductor research and development. In 2025, the passage of the One Big Beautiful Bill Act introduced a provision allowing businesses to deduct research and development expenses, further incentivizing investment. These funds are crucial in advancing the next generation of skilled workers who will support the industry.

What It Means for You: Three Things Facility Owners Need to Know as They Plan Their Next Fab Project

- Even in states leading the way in fab construction, building a semiconductor manufacturing facility in the United States typically takes around 38 months, nearly twice as long as the average 20-month timeline in Taiwan. American fab projects also tend to cost about twice as much. These disparities stem largely from Taiwan’s deep industry experience, as well as regulatory, labor and supply chain challenges faced in the United States.

To improve efficiency, the industry is increasingly adopting digital twin technology. By simulating construction during the design phase, companies can identify and resolve potential issues before breaking ground, boosting productivity and reducing environmental impact.

One of the most effective ways to streamline fab development is to involve a general contractor and design team early, even as early as the site selection phase. Early collaboration ensures more accurate cost estimates, scheduling and permitting insights, helping companies meet production timelines and ROI goals. Choosing a technologically advanced construction partner with tools like targeted-value design, data-driven scheduling, and BIM-enabled digital twins can significantly enhance efficiency and accelerate project delivery. - As manufacturing technology rapidly evolves, retrofitting semiconductor fabs every few years is neither cost-effective nor efficient. To stay ahead, manufacturers should focus on future-proofing their facilities. Consider designing fabs with built-in flexibility from the beginning. A purpose-built campus layout that anticipates equipment upgrades and allows for phased expansion enables manufacturers to respond quickly to market shifts.

- Site selection is one of the most critical decisions when building a semiconductor fabrication facility. Evaluating key resources – such as access to water, power and a skilled workforce – is essential. Equally important are favorable regulatory environments, fast-track permitting processes and tax or economic development incentives. These factors play a major role in ensuring a successful production start-up and the long-term viability of fab operations.

With decades of experience delivering complex, high-tech facilities across North America, PCL Construction is primed and ready to support the next wave of semiconductor manufacturing. From early planning and site evaluation to advanced construction technologies and collaborative delivery models, PCL brings the expertise, innovation and agility needed to help owners build smarter, faster and with long-term success in mind.