Dive Brief:

- Artificial intelligence demand pushed semiconductor tester and robotics company Teradyne’s fourth quarter revenue up 44% year-over-year to $1.1 billion.

- Results were driven by demand in computing, networking and memory within the company’s semiconductor testing business, Teradyne CEO Greg Smith said in a Feb. 2 press release. The segment accounted for $883 million in revenue.

- Overall 2025 revenue was $3.2 billion, up 13% from 2024. Looking ahead, Smith said that Teradayne expects AI demand to drive YoY growth across all of its businesses.

Dive Insight:

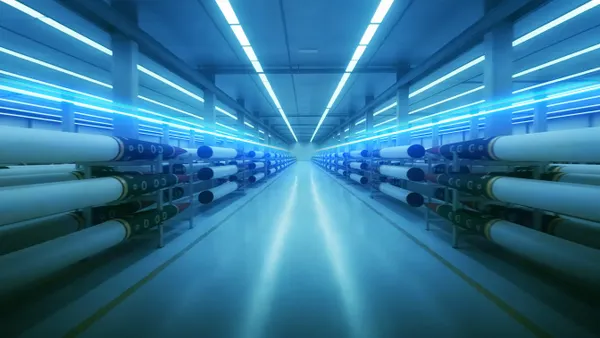

The results come as AI data centers are being built around the country, driving demand for a host of tech-related services offered by Teradyne and others.

On an earnings call Tuesday, Smith said the company’s increased AI-related revenue in the second half of 2025 was “striking.” Although this result was expected in the computing and memory sectors, he said, the rapid build-out of cloud and edge AI unexpectedly spiked demand in other areas like power management and optical testing.

All told, AI drove 40% to 50% of Teradyne’s revenue in Q3 and more than 60% in Q4, Smith said.

He noted that in 2020 and 2021, the Massachusetts-based company’s business model was dominated by mobile devices. This left it highly exposed in several areas, such as wireless testing.

By contrast, in 2025, computing was the largest revenue component and grew 90% year-over-year. Smith attributed this growth to recent investment decisions.

“Our historically strong networking business has been growing because of the high density of network connections in AI data centers and the increasing complexity of networking components,” he said. “The work that we have done to align our product roadmap and customer facing teams to VIP and merchant computing customers has enabled us to capture valuable new design wins.”

Smith said the markets Teradyne operates in are “unequivocally” poised to grow further in 2026. The AI data center market is the “prime mover,” he said, and the company’s product lines cover this market from computer device testing to robot-assisted operations.

The long-term outlook in other areas is also bright, including moderate recovery in auto/industrial and mobile. Smith expects Teradyne to gain market share in these areas in 2026 and beyond.

Still, the company anticipates more than 70% of its revenue to be driven by AI-related demand in Q1 of 2026, according to a slide presentation.

“Teradyne is positioned to deliver better than market growth in markets that are going to be growing robustly over the next few years,” Smith said.

AI is driving multibillion-dollar results for other companies as well. For example, Taiwan Semiconductor Manufacturing saw a net revenue increase of 35.9% in Q4 2025 compared to the previous year due to continued demand for AI.