Dive Brief:

- A survey of more than 500 manufacturing executives found that 93% believe the world is on the brink of the next industrial revolution and must reinvent how their companies operate in order to survive, according to PwC’s new Future of Industrials report.

- Industrial leaders are looking to reimagine their operations with an emphasis on supply chain resiliency, modular manufacturing, energy independence and autonomous systems as major shifts in technology, policy and global competitiveness take place.

- PwC surveyed industrials and C-suite leaders across aerospace and defense, automotive, chemicals, engineering and construction, oil and gas and energy. About 73% of the respondents agreed the companies that fail to embrace industrial realignment will be irrelevant within a decade.

Dive Insight:

Considering the fast advancements in artificial intelligence and the move away from supply chain globalization to geopolitical sovereignty, “those who don’t change … I think do face a level of irrelevance,” said Ryan Hawk, an industrial products and services leader at PwC.

“People are becoming much more internally focused and doing things that are … within a national interest because they see it as a competitive advantage,” Hawk said.

The so-called industrial revolution starts with bringing production closer to major markets. This year, manufacturers across sectors, such as Apple, Eli Lilly, TSMC and more, have committed billions of dollars in U.S. investments. Automation has lowered the cost of reshoring and U.S. tariffs and tax incentives are driving the change, according to PwC. Additionally, local production promises better quality control and speed to market.

If no action is taken, about 90% of executives believe companies relying on distant suppliers in 2030 “will be extinct by 2035,” according to PwC’s survey.

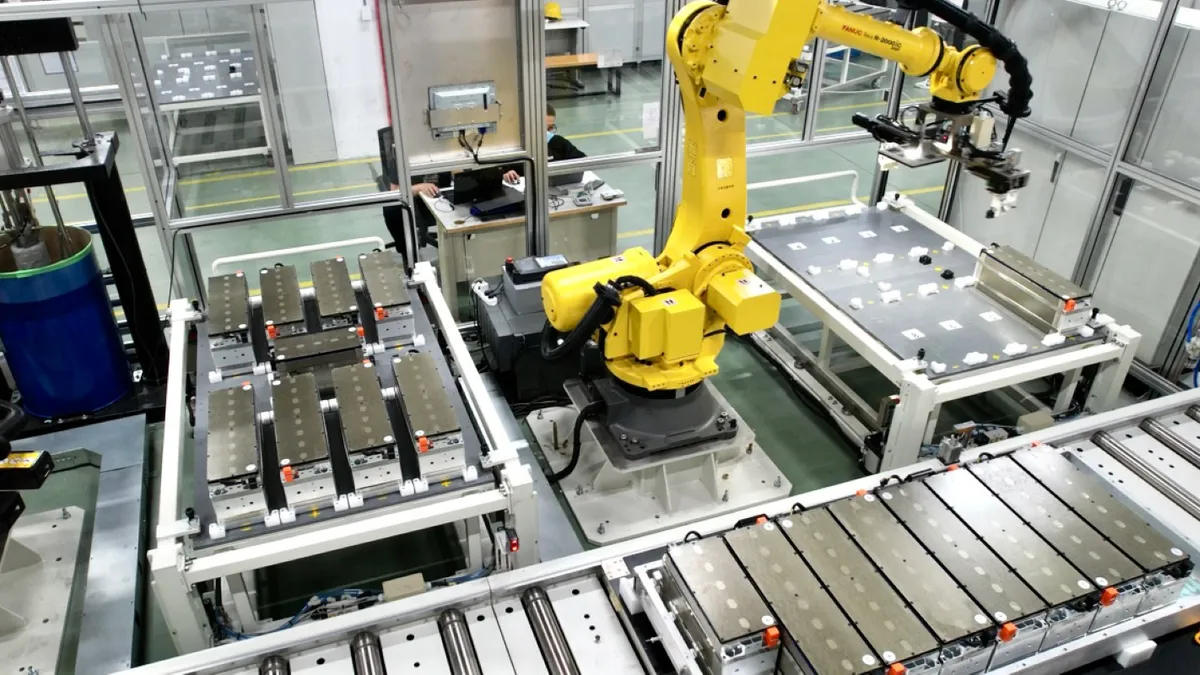

Beyond supply chain realignment, factories are becoming more autonomous and worker skillsets are changing. Over the next five years, nearly half of the surveyed leaders expect their operations to be fully modular, a strategy that breaks production into separate modules for added flexibility. That is up from about 6% of C-level decisionmakers who consider their operations fully modular today.

Executives are also backing “self-healing supply chains” that can automatically detect, diagnose and correct disruptions, according to PwC. Technologies with self-healing capabilities such as predictive maintenance and digital twins have the potential to bolster supply chain resiliency and reduce downtime costs.

As technology advances, robotics are augmenting human jobs. Nine out of 10 executives believe AI is forcing them to rethink job roles in the sector, and preparing employees for this shift has become a top workforce development priority.

“I think the work changes. I think the skills change. I think in some cases, the skill level changes,” Hawk said. “I think in other cases, the very way we educate people might have to change.”

By 2030, about half of the surveyed leaders believe AI will have taken root within their workforces, with 33% thinking most roles will be enhanced with intelligent tools or AI augmentation, according to PwC. In this future, “chips are the new oil” and “data centers are the new factories.”

Reflecting on the overall survey, Hawk said that he was surprised to find that executives overwhelmingly agreed they are at the “tipping point” of the next industrial revolution.

“Just how prevalent this feeling is, that things are going to change in some pretty big ways, and I think pretty fast too,” Hawk said.