Dive Brief:

- Deere & Co. ended its fiscal year 2025 on a high note, reporting higher tractor and construction equipment sales in recent months amid tariffs and a slow farm economy.

- The Moline, Illinois-based manufacturer reported worldwide net sales and revenue of $12.3 billion in the fourth quarter, up 11% over last year. This was driven by segment sales increases of 10% in production and precision agriculture and 27% in construction and forestry.

- Despite the recent sales surge, higher production costs and tariffs affected profitability. The company posted Q4 net income of nearly $1.1 billion, down 14% over last year. It also reported earnings declines for the full year and offered a muted fiscal year 2026 outlook.

Dive Insight:

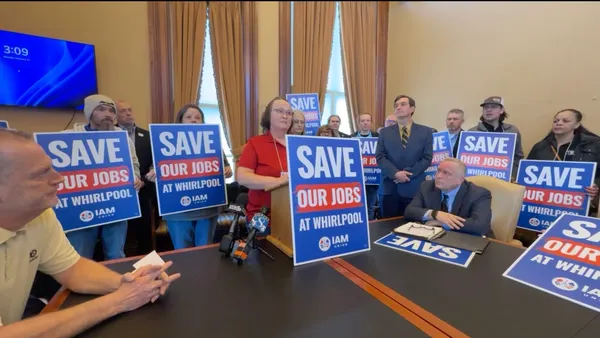

In recent years, tractor makers have navigated a down cycle in the U.S. market as farmers struggle through a period of elevated costs and low crop prices. As a result, Deere and competitors have cut production, resulting in several factory layoffs, and worked to manage inventory levels to meet demand.

“2025 marked a year of significant challenges and uncertainty, but it also reflected the resilience and strength of the Deere organization as we continue to demonstrate structurally higher performance levels while making substantial progress on our smart industrial journey,” Deere CEO John May said on an earnings call Wednesday morning.

Deere launched its smart industrial strategy in 2020, which focuses on incorporating artificial intelligence, automation systems and other leading technologies across operations. Since then, the company has seen income and margin levels start to improve amid unfavorable conditions, May said, adding that this strategy will be a key growth driver moving forward.

For fiscal year 2025, Deere reported worldwide net sales and revenue of $45.7 billion, a 12% decline over the previous year as challenges from tariffs and a slow farm economy weighed on demand. Net income totaled $5 billion, down 29% from a year ago.

“I am incredibly proud of how our organization has delivered exceptional performance in the current environment, while also continuing to advance the development and delivery of solutions that have the potential to unlock tremendous value for our customers,” he said.

Looking ahead, May is optimistic that fiscal year 2026 will mark the bottom of the down tractor cycle plaguing the industry. For the U.S. and Canada, the company is forecasting sales of its large agriculture products to be down roughly 15% to 20% next year. Meanwhile, construction and forestry sales are expected to grow 5% or be flat for the region.

Deere is forecasting a net income range of $4 billion and $4.75 billion next year.