Dive Brief:

- Boeing’s commercial aircraft deliveries ended 2025 on a high note, hiking up 72.4% year over year with 600 planes distributed, according to a Jan. 13 press release.

- Boeing’s fourth quarter deliveries also finished strong, jumping approximately 181% to 160 aircraft compared to the same period last year. The company delivered 117 of its 737 model aircraft, 10 of its 767s, six 777s and 27 of its 787 units in Q4.

- Additionally, Boeing concluded the year with 1,175 commercial gross orders, surging about 107% YoY. The company also outsold major competitor Airbus, which documented 1,000 orders last year.

Dive Insight:

Boeing’s order numbers mark the first time the company has beaten Airbus since 2018. At the time, Boeing recorded 1,085 plane orders and Airbus reported 747 orders.

While Boeing’s orders outpaced Airbus’, the France-based company has them beat in deliveries. Airbus delivered 793 planes in 2025, falling 27 short of its goal to distribute 820 aircraft by year’s end.

Boeing’s deliveries jumped about 181% YoY in Q4 2025

Boeing got the Federal Aviation Administration’s approval to increase its monthly 737 Max production rate from 38 to 42 in October 2025. The agency held a heavy hand over the company after a door plug blew out during an Alaska Airlines flight in January 2024.

Additionally, the FAA allowed Boeing limited authorization to issue airworthiness certificates for some of its 737 Max and 787 Dreamliner plane models in September.

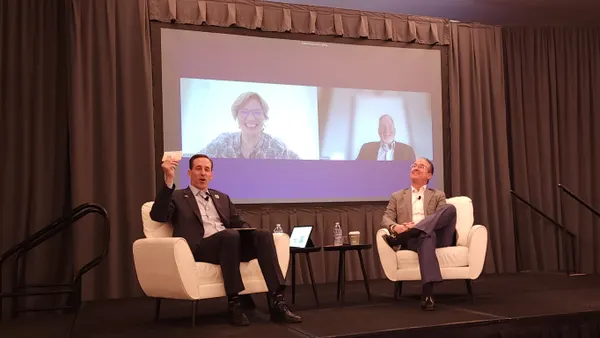

Jesus Malave, Boeing CFO and EVP of finance, said at a UBS conference in December that the 42-a-month rate is “going according to plan.” He noted, however, that it takes a few months to adapt Boeing’s manufacturing system and move it into production, which he expects will begin in Q1.

Boeing’s orders in 2025 surged 107% and deliveries rose about 72% YoY

“When I look at deliveries in terms of what we generally have guided to for 737, including — as well as 787, we expect to be pretty much where we were for the year,” Malave said.

Boeing also expects deliveries to increase in 2026, particularly for its 737 and 787 models, as it would be a “large driver of positive cash flow” for the company, the CFO said.

“The beauty of increasing our delivery rates is that the working capital cycle will move faster,” Malave said. “So your holding period, just your cycle time will be lower. You'll be moving inventory faster, which frees up cash.”

Once the production system is stabilized at the monthly 42 rate for six months, the company will begin discussing how to increase the monthly quota. But Malave said it gets harder as rates increase.

“Six months is probably the best performance we’re going to see, but our history tells us it takes a little bit longer than that,” Malave said.

Boeing plans to release its 2025 Q4 and full-year earnings on Jan. 27, which will include the deliveries’ impact on the company’s finances.