4 manufacturing trends to watch in 2025

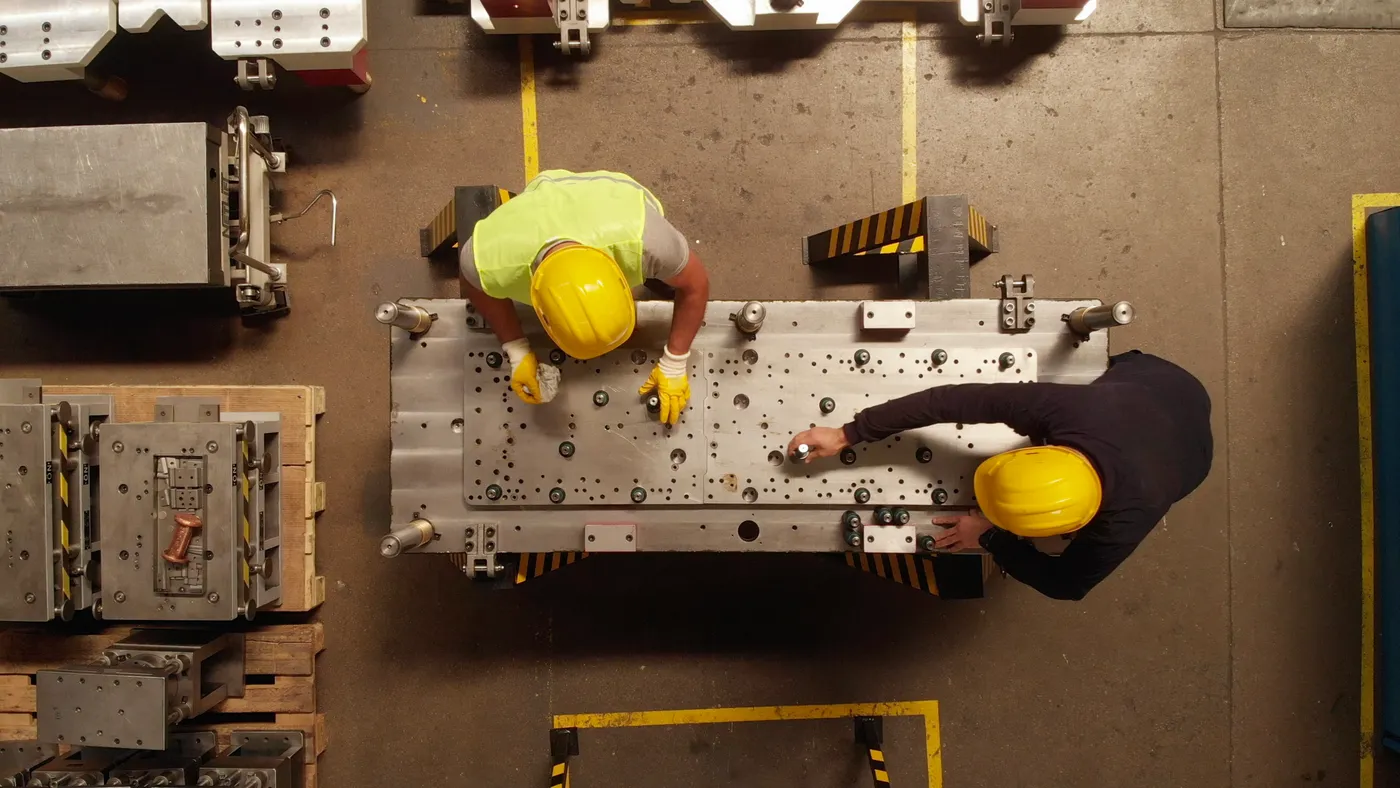

The manufacturing industry is set to stay in the national spotlight in 2025.

Taking office in less than two weeks, President-elect Donald Trump’s upcoming domestic policy agenda is centered around growing U.S. jobs, particularly in manufacturing.

Trump plans to use aggressive tariffs to entice companies to build factories in the U.S. The president-elect has announced plans to impose 25% tariffs on imports from Canada and Mexico, as well as additional 10% duties on goods from China.

Whether that plan can work, however, hinges on how well the country can recruit and retain manufacturing talent, a challenge that has plagued the industry for years.

In addition, artificial intelligence poses a challenge for manufacturers to integrate the technology in cost-effective ways. Doing so could help fill labor gaps, but with a hefty upfront price tag.

These factors are set to shape the manufacturing industry over the next twelve months. Read on to learn how manufacturers are navigating the challenges and what experts say executives need to know for the year ahead.

1. Tariff hikes will pose a manufacturing supply chain challenge

Trump’s tariff plan is putting pressure on manufacturers to shore up their supply chains.

The move could mean higher prices for finished goods in the U.S. and make it more expensive for manufacturers to import needed components and raw materials, particularly from China.

“The reality of the supply chain is that U.S. companies rely heavily on components and raw materials coming outside the U.S.,” said Cortney Morgan, a partner in Husch Blackwell’s international trade and supply chain practice.

Given Trump’s intention to use tariffs as a tool to influence Canada and Mexico’s border policies, the duty hikes may be short-lived, Morgan said. Tariff hikes on China, however, are likely to remain in place longer.

Even if Trump’s tariff threats don’t become reality, the Biden administration has already imposed duty hikes that will continue to impact manufacturers. In December, Biden announced increased Section 301 tariffs on some solar manufacturing equipment, and in September 2024, the administration finalized tariff hikes on a variety of goods from China.

Against this contentious backdrop, many experts are encouraging manufacturers to diversify their suppliers, with a particular push to lessen reliance on China.

Additionally, manufacturers should scrutinize their supplier contracts to share or even avoid bearing duties costs, Morgan said.

“The best case would be if you can avoid being the importer altogether,” Morgan said. “If you can push that off and then somehow get the foreign supplier to agree to do the [delivery duty paid] transactions where they’re clearing the goods and paying the duties.”

Another option is to take a proactive approach to long-term supply agreements, Morgan said, to create contract terms in which if tariffs rise, the cost is shared between parties.

2. Onshoring is happening, but industry impacts will take time

While Trump’s heavy tariff regime might spur more factories to open stateside, the domestic investment trend has more to do with cultural and technology factors than politics, said Tom Kurfess, chief manufacturing officer at the Georgia Institute of Technology and executive director of the Georgia Tech Manufacturing Institute.

Kurfess pointed to supply chain fragility and national security as two issues influencing companies to onshore manufacturing, including for high-tech products like semiconductors.

The Biden administration has taken more action in recent months to protect national security related to advanced manufacturing. Last month, the administration rolled out new export controls on advanced semiconductor equipment shipped to China, a move meant to protect U.S. national security.

At the same time, more companies want to avoid possible logistics and supply hiccups by shortening their supply chains. For some, this could mean more, smaller, factories that rely on nearby suppliers, Kurfess said.

However, even as manufacturing construction spending booms for new factories, it will take time for those projects to come online. In the meantime, companies need to focus on diversifying sourcing and boosting productivity and efficiency, said Steve Shepley, vice chair and U.S. industrial products and construction sector leader at Deloitte.

“When they look at the type of supply that needs to be sourced from the U.S., of course, that will have a higher cost profile than the other locations that you have been using historically,” Shepley said. “So this is going to put a whole other level of focus on the productivity of what you source.”

As more domestic factories open in the months and years to come, it will highlight a challenge that has loomed over the industry for years — labor constraints.

“A lot of companies are going to realize, not only do they need a bill of material for their products, they need a bill of labor, and that billable labor cannot be just at the general level of just ‘I need this many technicians, and this many direct line workers.’”

Steve Shepley

Vice Chair and U.S. Industrial Products and Construction Sector Leader, Deloitte

3. Talent recruitment and retainment will remain an obstacle

More than 55% of respondents surveyed for the National Association of Manufacturers’ Q4 2024 Outlook listed recruiting and retaining top talent as a primary business challenge. And while that’s actually a slight improvement over recent years, the issue remains a pivotal long-term operational challenge, Shepley said.

Companies need to stop thinking about recruitment strategies as a “reactionary” tactic, Shepley said, instead creating proactive long-term plans.

“A lot of companies are going to realize, not only do they need a bill of material for their products, they need a bill of labor, and that billable labor cannot be just at the general level of just 'I need this many technicians, and this many direct line workers,’” Shepley said. “You actually have to bring it down to the trade and grade levels that you're going to need over a three, four, five, six, maybe 10-year timeframe.”

Manufacturing sentiment jumped at end of 2024

Shepley encouraged manufacturers to work with trade schools and community colleges to train workers for skills that may not require a four-year degree.

“If you can really understand exactly the talent that you need and the technical skills that they need, there are certainly ways for folks to get that education and to gain those skills much more affordably in the past,” he said.

Many manufacturers are also exploring flexible work structures such as four-day workweeks and job sharing, said Ingrid Tighe, president of the Michigan Manufacturing Technology Center.

Tighe mentioned one injection molding company in Michigan that employed recent retirees for 10 to 20 hours per week as a way to grow its workforce. Another manufacturer coordinated with employees to make vehicle repairs to ensure people could get to work.

Both examples, Tighe said, illustrate creative ways in which companies are “meeting employees where they are.”

4. AI is here to stay. Manufacturers are on board

Manufacturers are increasingly integrating AI on the factory floor to boost production speeds, cut costs and fill labor gaps.

Randy Carr, CEO of Florida-based emblem and patch manufacturer World Emblem, said the company is spending 25% of its technology budget on generative AI. Their goal is to see a return on investment within 12 months.

“We just think that we should be able to ROI every single thing we do using generative AI really quick,” Carr said.

“With change, you get some resistance. Clearly there is a situation where the better this technology improves, the likelihood that changes of employment could take place. We just have to be sensitive to that.”

Randy Carr

CEO, World Emblem

Two of the manufacturer’s primary use cases for AI include improving customer interactions and expediting the design production process. World Emblem is now using AI to automate the process of taking hand-drawn designs and creating vector images. Carr said the goal is for AI to lead to a 15% increase in output.

The CEO noted that the tech integration has been met with some reservations from employees, which will take time to overcome and prove the technology’s benefits.

“With change, you get some resistance,” Carr said. “Clearly there is a situation where the better this technology improves, the likelihood that changes of employment could take place. We just have to be sensitive to that as we go down this path.”

Manufacturers are also using AI to perform predictive maintenance on equipment, as well as to aggregate and analyze operational data.

As companies weigh how much of their budgets to dedicate to new technology, Shepley encouraged manufacturers to prioritize customer-side investments to more quickly meet and anticipate client needs, and then turn to operational investments that help predict demand over time.

“Given the increasing cost of technology deployment, companies really need to focus more on how, through quick sprints, to try to drive value out of these technology transformations,” Shepley said. “As they look at their different initiatives, they do need to start to link those initiatives together a bit better.”