Advanced manufacturing leaders are navigating one of the most complex buying environments in decades. Economic pressure, regulatory scrutiny, workforce challenges and rapid technological change are converging, while the behavior of manufacturing buyers is quietly but fundamentally shifting.

New research from G&S Business Communications’ Beyond the Noise study of U.S. business leaders shows a sector that remains confident and forward-looking. More than 85% of executives say they believe U.S. manufacturing is globally competitive and nearly two-thirds report active investment in AI and automation.

Yet confidence does not equal simplicity. Trust is no longer automatic and visibility now begins long before a sales conversation ever starts.

AI has become the first stop in the buyer journey

Manufacturing buyers are searching differently than they were even 18 months ago. Increasingly, AI-powered tools are becoming the starting point for research, discovery and supplier evaluation, often before a website is visited or a salesperson is contacted.

“AI engines are starting to become the first impression for manufacturing brands,” said Beth Crisafi Smith, SVP and Advanced Manufacturing and Industry Practice Lead at G&S Business Communications. “If your company isn’t showing up clearly and credibly in AI-generated answers, you may not be showing up at all.”

This shift, often referred to as Generative Engine Optimization (GEO), is forcing manufacturers to rethink how they communicate expertise. Broad brand narratives and dense technical language are giving way to clear, question-driven content that reflects how buyers actually make decisions.

“Our research shows leaders are prioritizing product quality, cost control and advanced technology adoption,” Smith said. “Communications must speak directly to those pressures with proof, not platitudes.”

Trust is built through evidence, not aspirations

While sustainability and decarbonization remain important, with more than half of executives saying industrial decarbonization is extremely important, the Beyond the Noise research reveals growing skepticism around what are often vague corporate commitments.

“Sustainability has become a trust signal,” Smith noted. “But the companies that stand out are the ones transparently demonstrating progress, not just setting goals.”

For Dr. Bill Bryant, Director of Marketing at CarbonFree, credibility depends on consistency across the buying committee.

“In industrial markets, you’re rarely communicating with just one person,” Bryant said. “You’re speaking to engineers, procurement, operations and executives at the same time. If the story doesn’t hold together across those audiences, trust erodes quickly.”

Bryant added that manufacturers are under increasing pressure to translate complex sustainability and decarbonization efforts into tangible outcomes, such as improved performance, cost efficiency and operational resilience.

Human expertise still matters in an AI-driven world

While AI is reshaping discovery, people remain central to trust-building. Buyers want to hear from experts who understand their challenges and can explain solutions in practical terms.

“At Xylem, we’re seeing engineers and operators use AI tools to research faster,” said Snehal Desai, EVP and Chief Growth & Innovation Officer at Xylem. “But they still want validated answers, data and real-world experience.”

Desai emphasized that educational content, designed to answer real questions rather than sell products, performs best across both human and AI audiences.

“People aren’t looking for polished pitches,” he said. “They’re looking for answers. When your experts show up with clarity and evidence, trust follows.”

The buyer journey is longer and more invisible, than ever

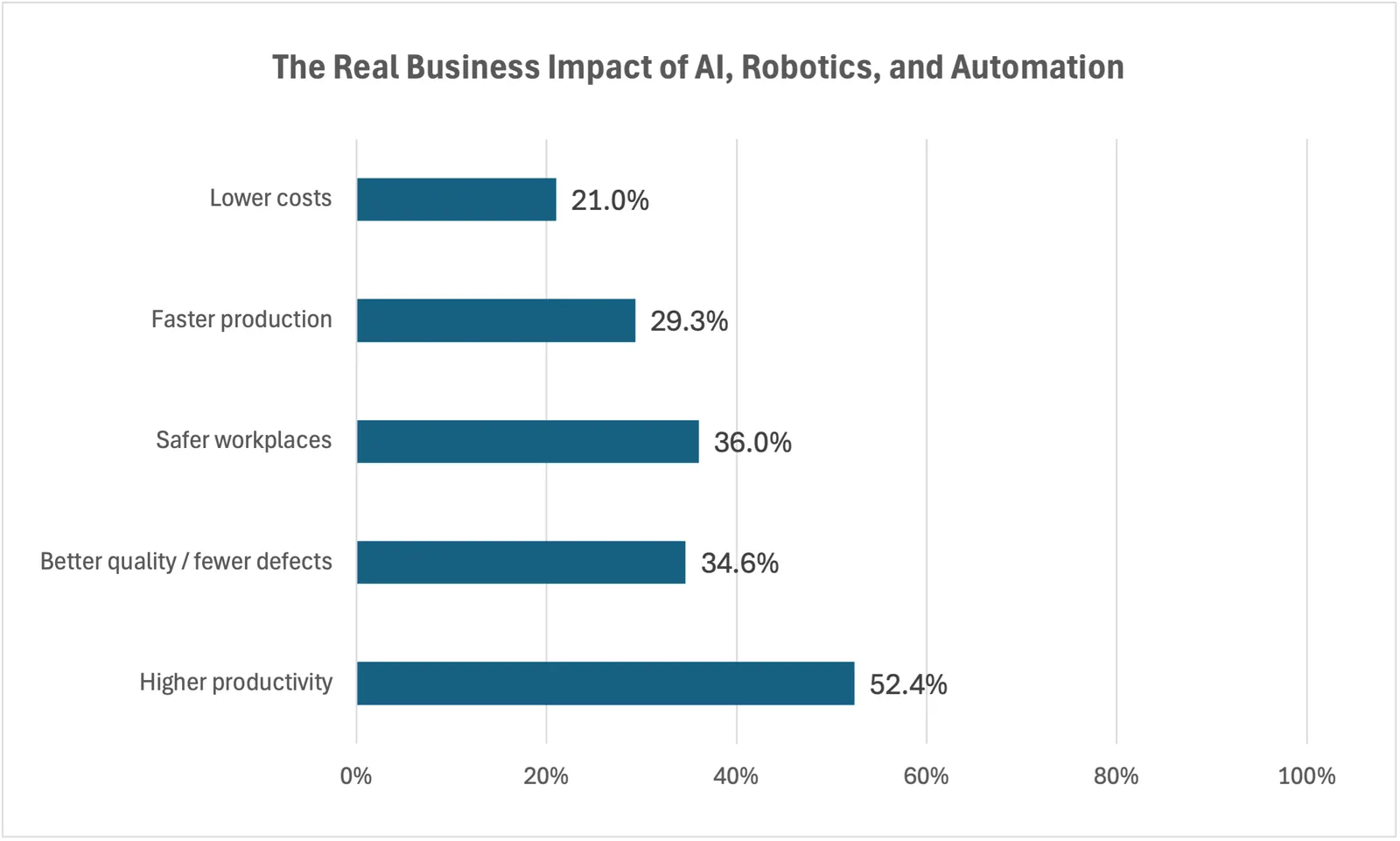

One of the biggest implications of AI-driven discovery is how much of the buyer journey now happens out of sight. According to the research, manufacturers are already realizing measurable benefits from AI and automation, including higher productivity, better quality, safer workplaces and faster production cycles.

“The challenge isn’t just standing out,” Smith said. “It’s aligning marketing, communications and sales around a clear, buyer-centered narrative that works whether it’s being read by a human or interpreted by an AI model.”

In a crowded and fast-moving market, trust and clarity are no longer differentiators. They are prerequisites.

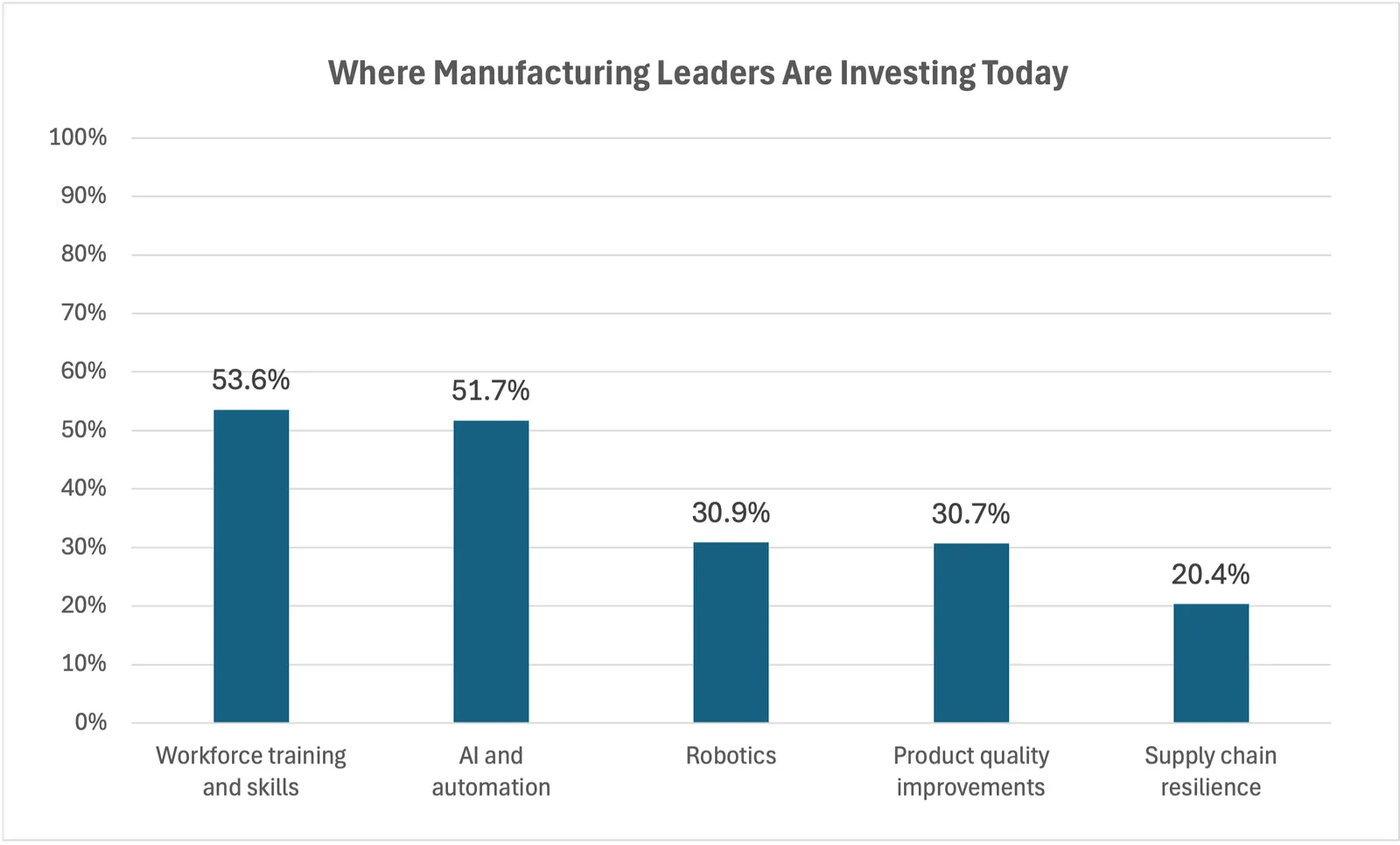

Data points (from Beyond the Noise business leaders survey):

- Workforce training and skills — 53.6%

- AI and automation — 51.7%

- Robotics — 30.9%

- Product quality improvements — 30.7%

- Supply chain resilience — 20.4%

Data points:

- Higher productivity — 52.4%

- Better quality / fewer defects — 34.6%

- Safer workplaces — 36.0%

- Faster production — 29.3%

- Lower costs — 21.0%