Dive Brief:

- A new special-purpose acquisition company focused on manufacturing and supply chain innovation, which is backed by Eric Trump and Donald Trump Jr., is seeking a $300 million initial public offering.

- The New America Acquisition I Corp., which filed a registration statement on Aug. 4, plans to raise the money by offering 30 million units valued at $10 per share. It will target businesses that play a “meaningful role” in revitalizing U.S. manufacturing and strengthening supply chains.

- The SPAC is led by Chairman and CEO Kevin McGurn, a longtime media and tech executive. It is also supported by the Trump brothers and Dominari Holdings President Kyle Wool, who all serve on the advisory board.

Dive Insight:

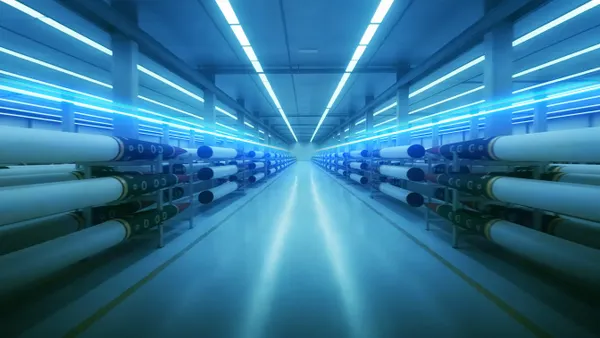

The SPAC comes as President Donald Trump looks to increase domestic manufacturing activity and rely less on foreign materials, specifically by advancing the country’s position in the semiconductor industry in the global race for AI dominance.

The Florida-based company said it plans to target businesses that are “deeply aligned with advancement of U.S. industrial capacity, technological leadership and innovation and economic resilience.”

“Through this strategy, the SPAC aims to generate long-term value while reinforcing America’s economic foundation and global competitiveness,” the company added.

SPACs are often referred to as “blank check companies” because their primary goal is to raise capital through an IPO and then use the money to acquire or merge with a private company.

Their popularity has come and gone since emerging in the 1980s. Most recently, they peaked in 2021, with 613 listings that raised $145 billion, according to Certuity, a wealth management firm. However, enthusiasm has since waned due to regulatory scrutiny, rising interest rates and changing investor sentiment.

Although SPACs are seen as an efficient way to take a company public, they have also historically underperformed. From 2021 to 2022, the acquired companies lost an average of 63% of their initial value, according to Certuity. The risk is also high that a SPAC fails to find an acquisition target.

Dominari Securities, a subsidiary of wealth management firm Dominari Holdings, and D. Boral Capital are acting as co-book-running managers and representatives of the underwriters of the New America Acquisition I Corp. IPO.

The SPAC is looking to apply to have the units listed on the New York Stock Exchange.