As tariffs and labor constraints shape the economic landscape, manufacturers are exploring process streamlining, domestic hiring, and nearshoring as key strategies for the rest of 2025.

For manufacturers unclear on the best way forward, experts recommend a long-term perspective — especially since such investments will carry costs beyond the year’s end.

Gregory DeYong, associate professor of operations management at Southern Illinois University said manufacturing leaders have and should continue to make investments with longevity in mind.

“Whenever manufacturing [organizations] make a decision, that's kind of long-term. I tell my students, when Ford builds a plant, they expect it to run for 100 years. They're not looking at tomorrow or next week or next month when they're making these decisions,” DeYong said.

As such, manufacturers who align investments with broader strategic goals, and keep reactionary decisions in check, will see the most long-term benefits.

Combating tariffs with leaner processes and nearshoring

The arrival of tariffs earlier this year brought only marginal clarity to the economic future of the industry, instead ushering in a pause in deal activity and decision-making, said Streamliners Management Consulting CEO Andreas Haag.

Considering the volatility of the tariff landscape — and the uncertainty of their extent or even existence in the future — Haag predicts that manufacturers will only invest in those solutions that might benefit them regardless of the fate of tariffs.

For many, that’ll involve following trends such as nearshoring, or relocating production closer to markets, and optimizing existing processes to absorb cost increases.

“My expectation is they will do cost reduction initiatives that are positive, even if the tariffs fall one day,” said Haag. “A lot of management focus is going to be on improving output and improving efficiencies to get your unit costs to offset the price increases from China.”

For others, nearshoring will help cushion the shock of tariffs — and may pay dividends even if they disappear in 2026.

“Nearshoring to say, Mexico or Central America (electronics in Costa Rica, for example) is justified when tariff costs outweigh savings from low-cost countries like China or there are short product life cycles due to new editions, models, etc, [making] response time to market key,” said Ted Stank, co-executive director of the Global Supply Chain Institute at the University of Tennessee Knoxville.

Unlike process streamlining, though, experts say nearshoring is not a bandwagon everyone should hop on, and is a trend that requires a little more nuance in its consideration. Depending on your product, investing in a new production facility entirely might actually be the more beneficial option.

“Investing in a new factory or warehouse makes more sense [when] establishing long-term production stability for industries with high-volume, long life cycle products, such as semiconductors or EVs,” says Stank.

That’s because downtime in such production facilities — or even a disruption in their volume of production — can translate into high costs.

“A good example is all the investment in computer chip manufacturing in the last four years, [such as] TSMC’s $40 billion investment in Arizona for advanced chip manufacturing — motivated by geopolitical tensions, security concerns, and U.S. subsidies,” said Stank.

Such investments make sense regardless of where manufacturers and their suppliers stand next year.

Commenting on the volatile situation that catalyzed such trends, DeYong said, “From a U.S. manufacturing standpoint, [this] is ‘good uncertainty,’ because this is the kind of thing that gives people an impetus to maybe make some calls that they were waiting on.”

Haag said whether manufacturers nearshore, or opt to source in the U.S., they shouldn’t cut ties with Chinese manufacturers.

“Make sure you have very good communication with your Chinese suppliers, maintain the relationships, and explain to them why you are now sourcing in the U.S., and that your intention is to switch back to them when or if the tariffs come down,” he said.

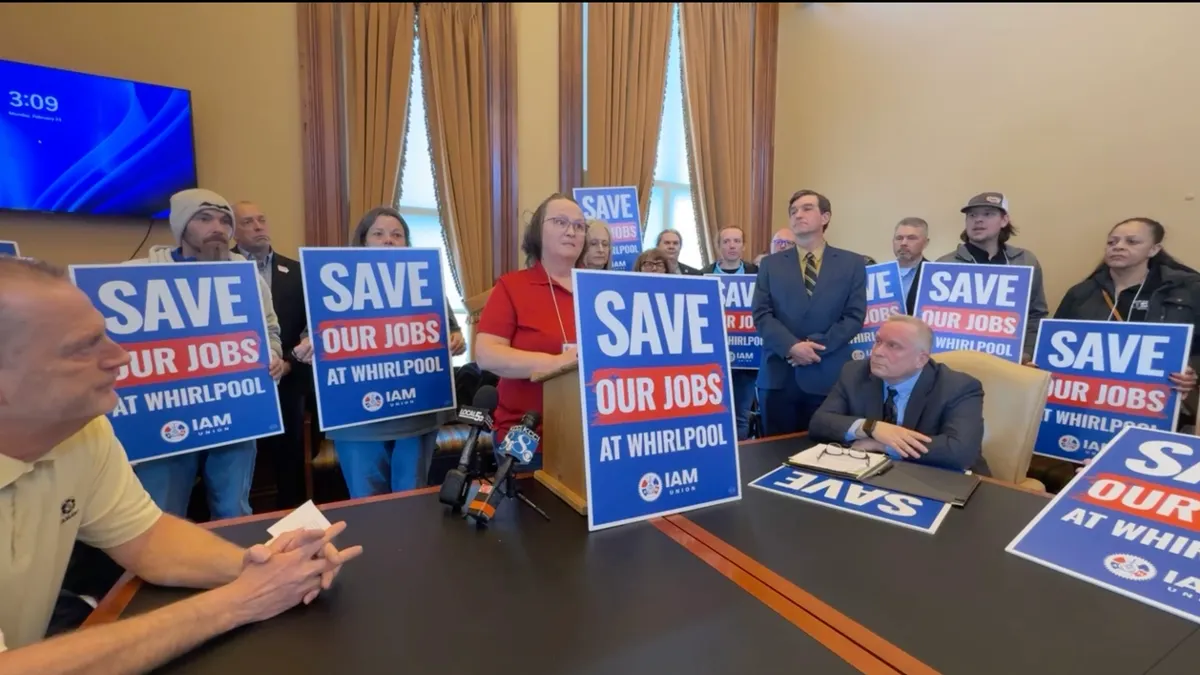

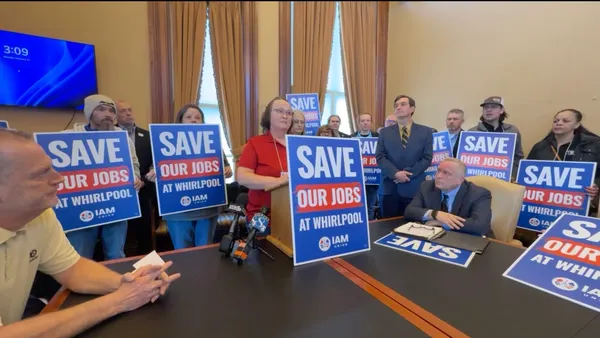

Labor shortages will press the deportation topic

According to a joint study by Deloitte and the Manufacturing Institute, American manufacturers could be short by as many as 3.8 million new workers by 2033, with 1.9 million of those roles going unfilled if today’s labor gaps go unaddressed.

Stricter immigration enforcement during 2025 has also caused sudden vacancies in critical operational roles, especially low-wage, physically demanding jobs that are difficult to fill, Stank said.

“This is a very significant issue,” Stank said. “In places where labor-intensive operations exist — particularly in the Southeast and Midwest — the reliance on immigrant labor is substantial. Workforce shortages can cause limited supply of products that will ultimately raise prices.”

Stank also said this activity could lead to rising wages.

“To attract domestic workers, companies have had to raise wages and offer additional benefits, increasing operations expenses. Remember what happened with wages in some industries during COVID? Same thing here!” he said.

But even with such incentives, Stank said some industries “struggle to recruit domestic workers for roles that are seen as undesirable due to working conditions, like meat processing, some construction (roofing for example), or agriculture field work.”

Some additional ways to adjust, according to Stank, include "focusing on hiring documented immigrants, including through visa sponsorship, or developing partnerships with community colleges or workforce agencies aim to retrain local populations."

"Will it be enough?” he asked. “Time will tell."