Claudia Saran is the industrial manufacturing sector leader at KPMG U.S., and Amy Matsuo is the regulatory insights leader at KPMG U.S. Opinions are the authors’ own.

The summer months signal the midpoint of the year and with it a chance to look back on the past six months, while also thinking of what’s around the corner. For those in the manufacturing sector its been a whirlwind year thus far, one dominated by uncertainties over the direction of tariffs and their implications for supply chain operations and critical investments.

As we speak with clients, a myriad of issues are top of mind for them these days, ranging from artificial intelligence to talent challenges to cybersecurity and digital capabilities to strengthen their operations. While there is no shortage of topics to focus on, there are three key issues we’re keeping an eye on for the second half of the year.

Navigating continued economic uncertainty

Supply chain resiliency, adaptability, and scenario planning have come to the forefront for manufacturers since the onset of the COVID-19 pandemic in 2020. They have become accustomed to operating in a macroeconomic and geopolitical environment in which uncertainty is a consistent theme.

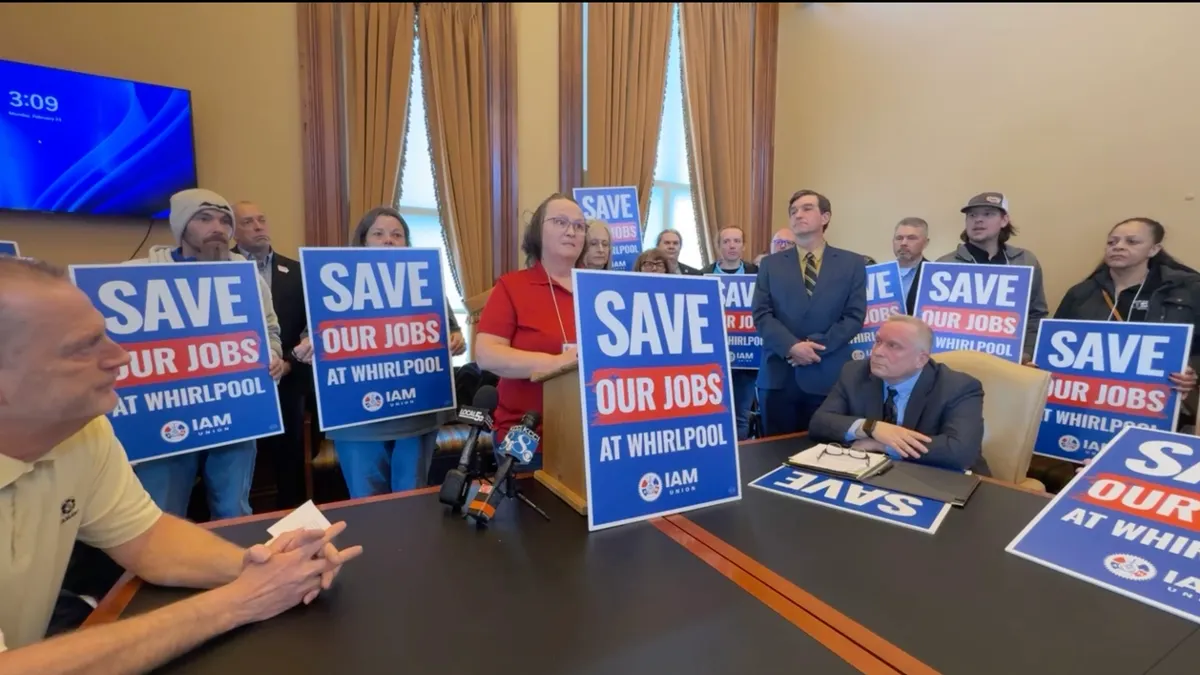

Part of that uncertainty thus far in 2025 has come from trade-focused policies such as tariffs. Across production lines, manufacturers’ resiliency has been tested as they assess possible costs and implications for their business models and operations.

Much like the first half of the year, leaders will need to remain agile and vigilant to ensure their organizations can continue to meet customer needs while also positioning themselves for sustained success over the long term.

Regulatory rebalancing

Tariffs are only part of a broader story when it comes to regulatory trends to monitor closely for the second half of the year. While headlines often focus on high-level deregulation narratives, the actual story on the ground is far more fragmented, sector-specific and reflective of evolving geopolitical positions.

When it comes to manufacturing in particular, the “America First” trade agenda signals continued tariffs and restrictions on products affecting sectors such as technology and automotive, including steel and aluminum imports.

At the same time, diverging priorities between federal and state governments are creating a fractured patchwork of labor, environmental and workplace safety standards. Notably, workplace safety requirements are becoming more stringent in certain states even as inspections (domestically and globally) are anticipated to change in intensity, frequency and focus. Additionally, immigration compliance and physical security remain a continued area of note for organizations.

Environmental policy is also in flux, eased at the federal level but reinforced in many states. In addition, global pressures are reshaping compliance. Stricter export controls and closer scrutiny of dual-use technologies reflect growing concerns over intellectual property and national security.

As we head into the back half of the year, we see an emerging regulatory environment defined by divergence and fragmentation, adding another layer of complexity to establishing a clear path for everything from strategy and operations to effective risk and compliance management.

The big question for the remainder of 2025 is: Will a deregulatory policy really equate to deregulation? Time will tell, but the most agile organizations will invest in scenario planning, real-time monitoring and flexible risk frameworks that allow them to move with, not against, the regulatory currents.

Talent and technology ROI

Last but not of least importance is how to attract and retain talent in an era where many are asking, “What does automation mean for the future of work in manufacturing?”

The reality is that a human-in-the-loop approach will remain critical but the nature of the work and the skills needed are evolving. Ensuring that organizations are attracting digitally literate talent to engage with the technology that firms have invested heavily in is essential to help derive the highest collective return on investment for manufacturers.

In short, heavy investments in technology that can’t be properly used or in data that can’t be well analyzed and applied is not a recipe for success. People with the skills to ask the right questions, to analyze data properly and to best utilize available technology are more important than ever. These individuals are in high demand across a variety of sectors, so manufacturers must pay close attention to their employee value proposition.